Each month we crunch data from the South Shore and Cape Cod Association of Realtors® Multiple Listing Services (MLS) to help our clients and community better understand the state of the local real estate market.

This report is for single family homes in Plymouth County and Barnstable County. Please note Condos, Multi-family homes and land are excluded.

Lets take a look 👇🏻

The market right now is anything but normal!

“Home sellers have historically moved when something in their lives changed; a new baby, a marriage, a divorce or a new job.” This comes from Jessica Lautz, the Vice President of Demographics at NAR. She says, “The pandemic has impacted everyone and for many this became an impetus to sell and make a housing trade.”

The pandemic caused a lot of people to say we need something different in a home, we need to make a different decision about our home, and we’re seeing the results of that in the market trends. She goes on to say, “The pandemic likely spurred occupants to shorten their home stay, as tenure in the home decreased from eight years—to eight years, from ten years, according to the report.” This is the largest single year change in home tenure since NAR began collecting such data.

More sellers this winter 🏡

People are ready to make the move...

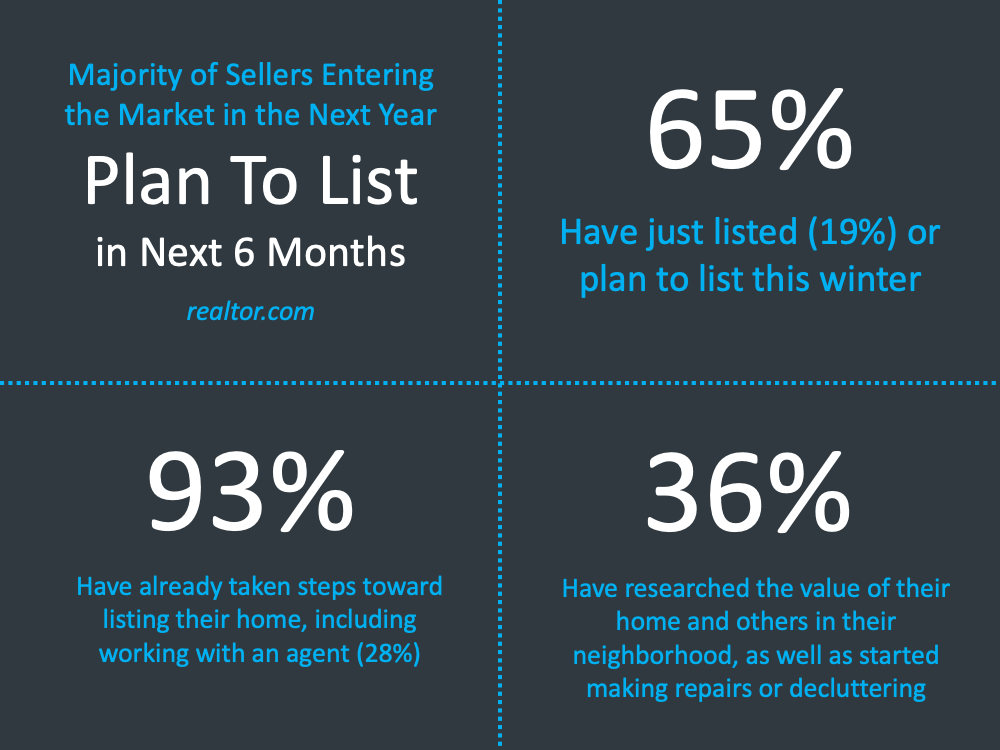

In the study mentioned above, 65 percent of folks said they have either just listed or plan to this winter, 93 percent say they’ve already taken the steps towards listing their home, including working with an agent, 36 percent have researched the value of their home and others in the neighborhood, as well as started making repairs or doing what they need to do to sell their home.

Today in this market, being prepared and being educated is the key.

It looks like we’re going to see more activity among sellers and among buyers than we’ve seen in quite some time. The pandemic has thrown real estate market seasonality out the window.

What's going on with interest rates?

Arguably one of the biggest updates or topics that’s going to be talked about as we go into the new year, the overall outlook is interest rates are going to rise.

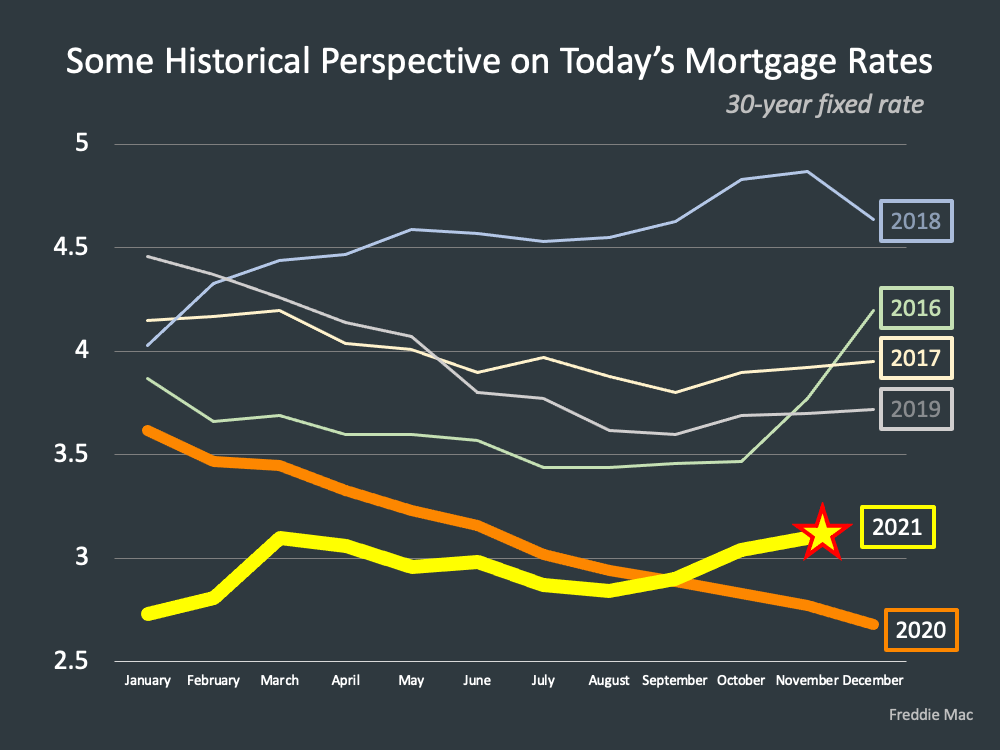

Right now the average 30-year fixed is 3.1 percent. This graph is a historical perspective on interest rates. We’ve seen some phenomenal rates over the last year or so, including historically low rates on a 30-year fixed. It looks like we’re heading back into a much more "normal" interest rate environment.

Rising rates = rising prices? 💵

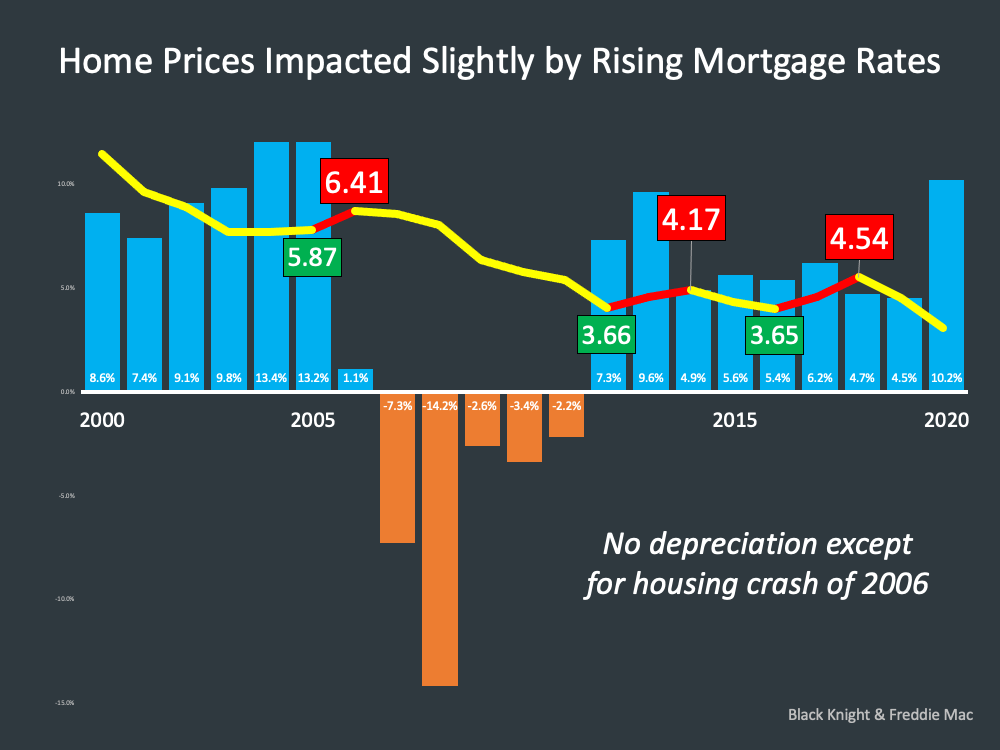

Home prices are only slightly impacted by rising mortgage rates...

Looking all the way back to 2000, you'll see the interest rate line, and the bar graph is appreciation or depreciation during the housing crisis. For each rising interest rate environment there’s no depreciation (except during the housing crisis) and when you start to look at rising interest rate environments, the first one around 2005, less appreciation in 2006.

With a rising interest rate environment in 2012, ‘13 and ‘14, less appreciation the last year.

The next rising interest rate environment in ‘16, ‘17 and ‘18, we go up and come back down a little bit, so a slight impact in home price appreciation. Price appreciation though, as we look at that, is resistant to rising mortgage rates and here’s why. Mark Fleming, sums this up best. “Home price appreciation is resistant to rising mortgage rates, primarily because most sellers would rather withdraw from the market than sell at lower prices.” So sellers are saying okay, if I can’t get as much for my home or if my home is not appreciating as fast, we’ll just take it off the market. Which means we don’t see depreciation in market, therefore price is slightly impacted by rising interest rate.

Are home sales impacted by rising interest rates?

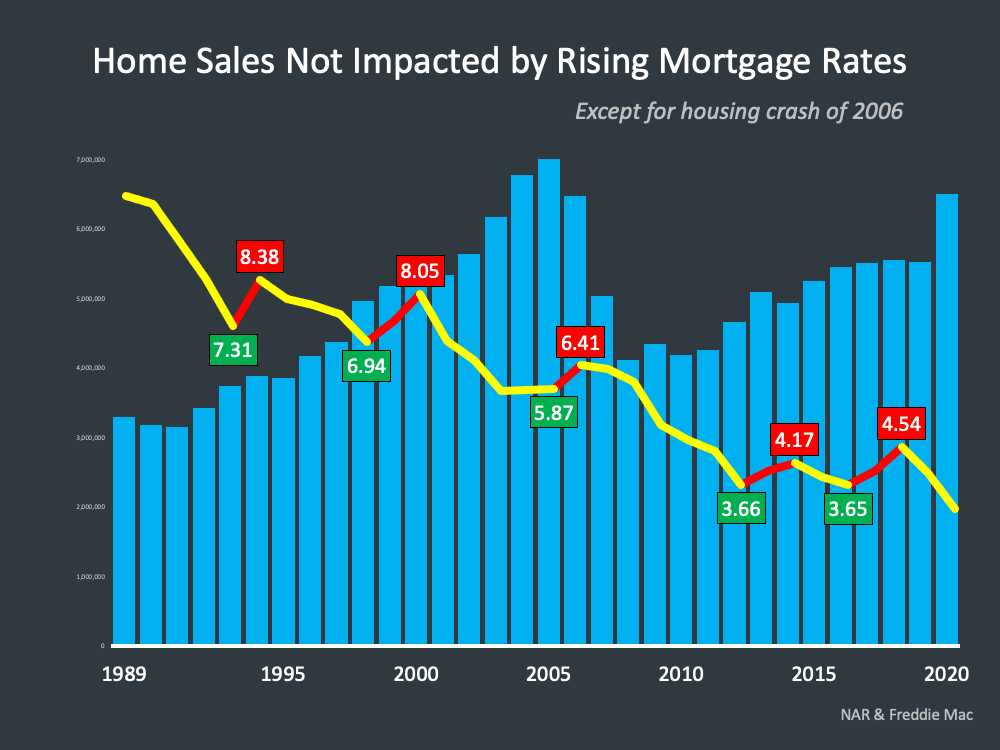

Looking all the way back to 1999, we have interest rates in the line graph and home sales in the bar graph. We can see home sales aren’t impacted by rising mortgage rates. Each one of the red bars representing rising interest rate environments and they’re not corresponding with lower home sales.

The economy is improving, millennials are continuing to age into their prime home buying years in large numbers, so the context remains good for the housing market. Sure it It will cost more to buy a home as we go through interest rate raises, but it doesn't historically have an impact on purchase demand.

What are your Biggest Concerns for 2022?

LET'S TAKE A CLOSER LOOK AT HOW YOUR TOWN DID IN DECEMBER OF 2021 ⤵️

In the Town of Plymouth, the amount of homes on the market have decreased from the beginning of the year. The days on market remained low with 18 days on average. The average sale price has increased, coming in around $563K the last few months.

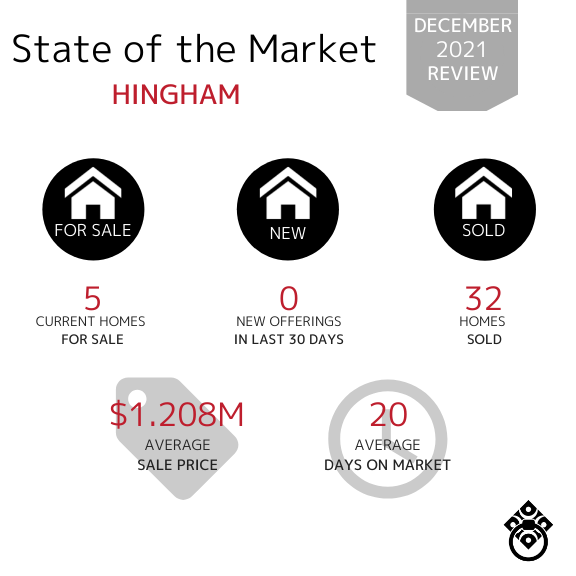

In the town of Hingham, the number of new homes entering the market has remained stagnant with no new offerings within the last 30 days. The average sale price has remained in the million dollar bracket at $1.208 million dollars this month. In addition, the town currently has 5 homes for sale.

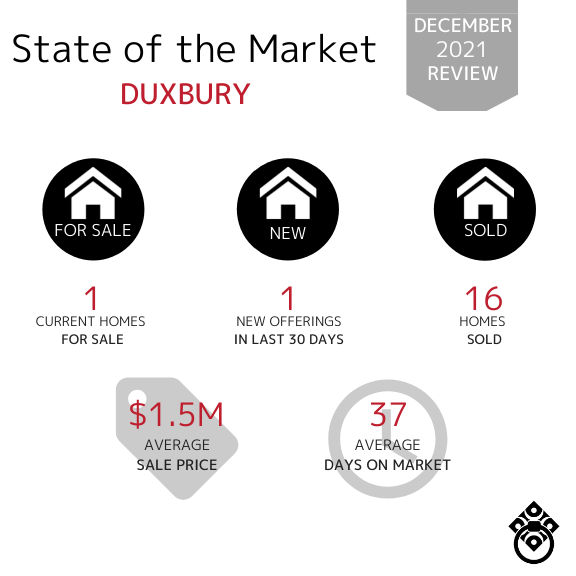

In the town of Duxbury, the average sale price is in the million dollar bracket with $1.5 million dollars. Although home sales have stayed relatively the same month over month on average. With 37 days in the month of December for average days on the market, this is a steady number on average for Duxbury.

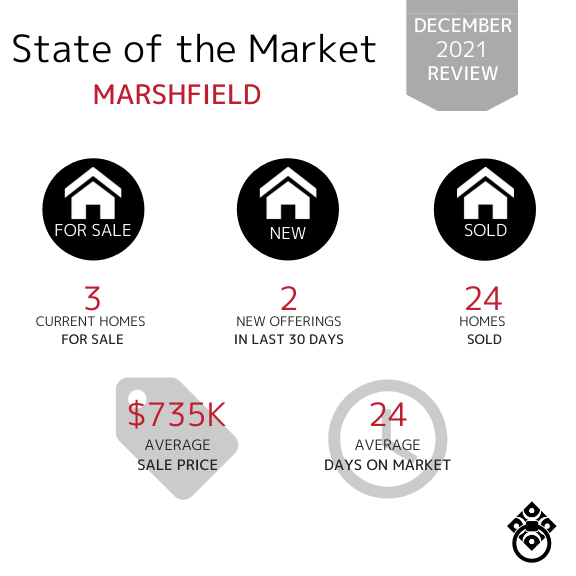

In the town of Marshfield, the number of homes sold remained consistent from January through December. The time properties are on the market on average is around 24 days. The Average Sales Price has stayed close to previous months, coming in at $735K.

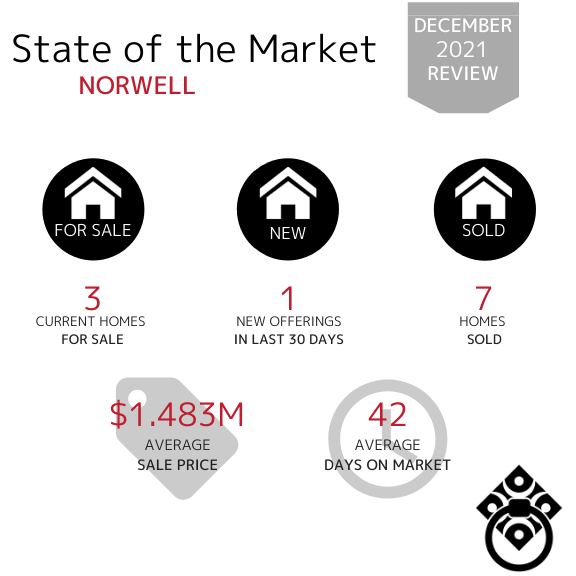

In the town of Norwell, the number of new offerings has decreased to 1 in the past month. The average sale price has stayed similar over the past few months, averaging out at $1.48 million.

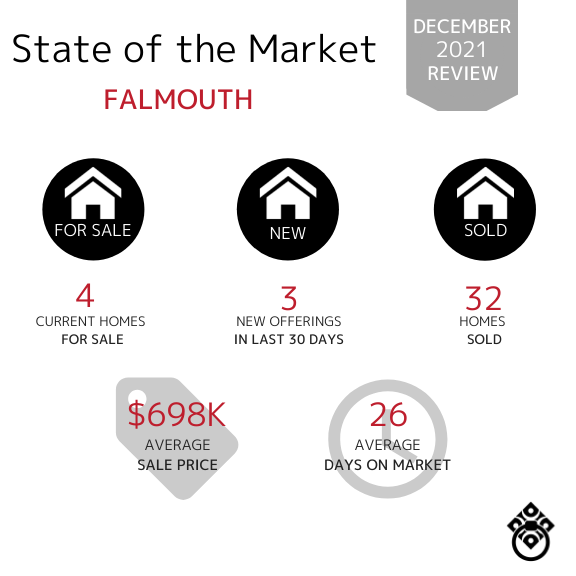

In the town of Falmouth, the number of homes sold remained consistent from January through December. The time properties are on the market on average is around 26 days. The Average Sales Price has stayed close to previous months, coming in at almost $700K.

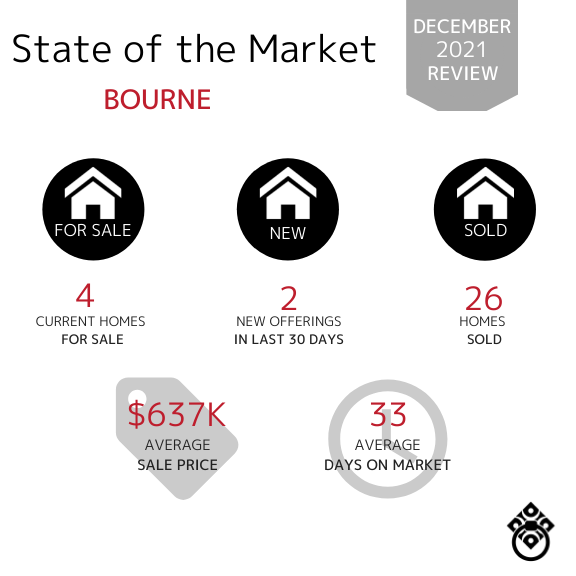

In the town of Bourne, the number of new offerings has decreased over the last three months. The average sale price has stayed similar over the past few months, averaging out at $637K.

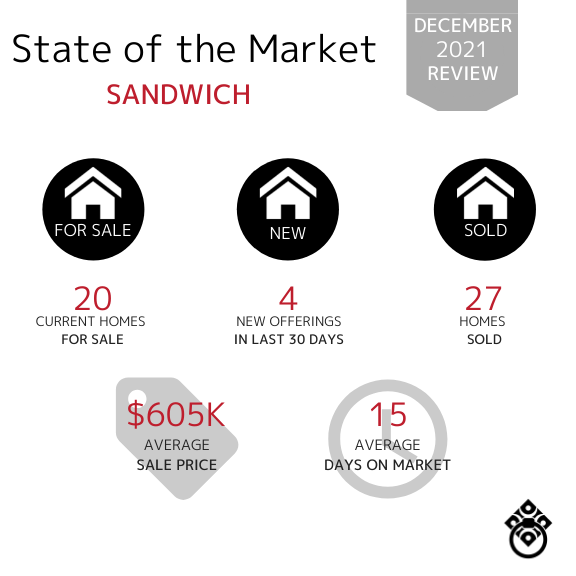

In the town of Sandwich, the number of homes sold remained consistent from January through December. The time properties are on the market on average is around 15 days. The Average Sales Price has stayed close to previous months, coming in at$605K.

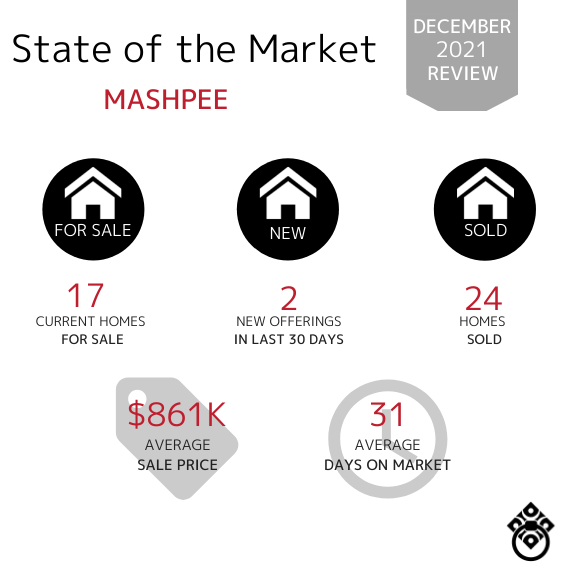

In the town of Mashpee, the number of new offerings has continued to decrease over the last three months. The average sale price has stayed similar over the past few months, averaging out at $861K.

If your town wasn't included in this report,

click here and let us know. We'll be happy to get you that data!

Learn How Much Equity Your Home Has Gained...

SELLER SUCCESS STORIES

SEARCH FOR HOMES

*Market Information obtained from MLSpin, Cape and Islands MLS and Keeping Current Matters*

.jpg)